When it comes to protecting our loved ones, we want to do everything in our power to make the right choices. With a couple of sudden deaths in the family, we have been discussing term life insurance and found it isn't easy to pick something. With high-value purchases, the first thing we do is to ask our friends, family, colleagues, and then Professor Google. However, when it is a matter of risk coverage and life insurance, it is important to be well-informed to make the right selection. In short, we must read the fine print and do our due diligence before signing the dotted line.

What three critical factors to consider when deciding on the best online term insurance plan? Here is what I learned.

Selecting the right term plan

- Start by considering term plans that offer the following:

- Critical illness benefit: A term plan offers death benefits after the death of the policyholder, but what if the policyholder doesn't die, and instead, contracts a critical ailment, like cancer, aplastic, benign brain tumor, or a similar critical illness? As per the National Institute of Cancer Prevention and Research, around 2.5 million Indians are living with cancer. Besides the medical trauma, the family's source of income will also stop. As if that is not enough, the rising medical expenses make matters worse. How to tackle this situation? Opt for a term plan with critical illness benefits. If the policyholder is diagnosed with a critical illness, she is eligible for a lump sum in the form of critical illness benefit from the insurer to meet her financial needs.

- Accidental death benefit rider: In 2015, the number of road accident deaths increased by 5% to 1.46 lakh. Road accidents often lead to death and this results in the family abruptly losing their source of income. To avoid this, insure yourself against accidents with the accidental death benefit rider. If accidental death occurs, your nominee will get the sum assured, which is over and above the base cover.

- Permanent disability benefit: What if you meet with an accident and lose a limb and become disabled for the rest of your life? Not being able to go to work in such a situation would mean inability to earn your livelihood. Added to this you will also have the extra financial burden of climbing medical expenses. The solution? Term insurance with permanent disability benefit where you will be eligible for monetary benefit based on the extent of your disability. Some insurers also waive off premium on permanent disability and continue to offer term insurance coverage till the tenure of the policy.

- Terminal illness benefit: This ensures that the policyholder gets the benefit on diagnosis of a terminal illness. The money is useful in this emergency.

- Choose the correct death benefit payout option

Choose the plan that offers you the flexibility to receive the death benefits in a way that would meet your multiple insurance requirements. Most insurers pay the entire benefit as a lump sum. However, when you take the impact of inflation into account, this amount may not be sufficient. Another issue is your nominee using this money in a way you do not want. To deal with the issue, some insurers offer an increasing income option where the benefit is payable in monthly installments for ten years, and thereafter, the amount increases by 10% per annum. You also have the choice of opting for the income payout option where you receive a certain portion of the benefit every year.

- Go for the right premium payment option:

Insurers allow you to choose from a number of premium payment options: single pay, limited pay and regular pay.

- Under single pay, you pay the entire premium up front. So if your policy tenure is 20 years, you will need to pay the entire premium of 20 years in the first year. This policy ensures that you do not miss your premium due date.

- With the limited payout option you make payment only for some years and enjoy coverage till the end of the policy tenure. For instance, pay the premium for five years only for the policy tenure of 20 years.

- In regular pay, you need to regularly pay the premium to get coverage. For instance, if your policy tenure is 20 years, then your premium paying term will also be 20 years.

The right insurance company

This one's obvious. Here is what you need to know:

- How old is the insurance company: Choose a reputed insurance company that has been in business for many years.

- What is their claim settlement ratio: Claim settlement is the number of approved payouts against the policy offered by the insurer on the policy holder's death. Look for a term insurance provider with a good claim settlement ratio

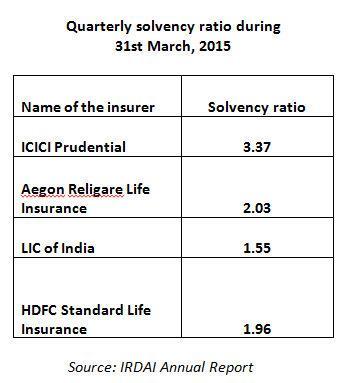

- Solvency ratio: Is the insurer financially sound? What about their ability to settle claims? A provider with a good solvency ratio will always be in a better position to fulfill their debts and other financial obligations. Take a look at this:

Before you choose one insurance company over another, it is a good idea to make a comparison table with product features and brand values. Once you get that information on paper, eliminate those term plans which do not fit in with your needs and then, make an informed choice.

Insurance can give you complete peace of mind, making you feel secure in the knowledge that you and your loved ones are protected and safe in case of a mishap.

Term insurance is a life insurance product offered by an insurance company which offers financial coverage to the policy holder for a specific time period. In case of death of the insured individual during the policy term, the death benefit is paid by the company to the beneficiary.

Writer, editor, blogger, social media enthusiast. Love DIY, Coffee, Music, Reading, Photography, Family, Friends and Life. Mantra: Happiness is a DIY Project. In my free time I play with my dust bunnies and show my diabetes who's boss. Tweet as @vidyasury