Since the start of the new year, I have been making a conscious effort to pay more attention to my finances - by budgeting, saving and planning ahead wherever possible.

One of the reasons I wanted to do this was to enable me to start doing something that I intended do four years ago when my first son was born, but never actually got around to - starting a Junior ISA savings account for him and his brothers.

With Jon having lost his parents at a very young age, we are all too aware that life is uncertain and for that reason we both want to be sure that our children are provided for should anything unforeseen happen - and in addition to that, one thing that is really important to me is that they each have a sum of money for us to gift them when they reach adulthood - to set them on their way in life.

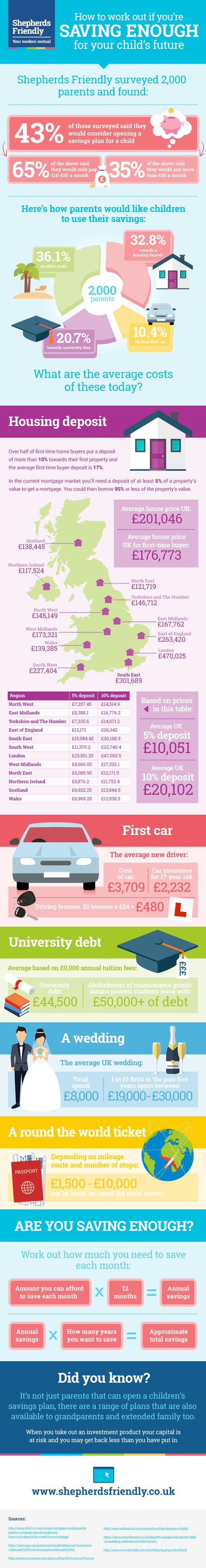

The below infographic shows how you can work out if you're saving enough for your childs future - my own hopes are that my children will use the money we save for them toward something like a house deposit or education if they wish, and so I've been putting away £10 per week per child. It's a small enough amount that it's not really noticeable to our budget - it's really just the sacrifice of a take away or two! - but it means that by the time they turn 21, they'll each have over £10,000. Perhaps not enough to fully cover a deposit on a house in the South West where we live, but certainly a good chunk towards it!

If you're interested in saving for your childrens future or curious about it, take a look at the helpful infographic from Shepherds Friendly below.

If you enjoy my blog, please consider following me on Bloglovin'