I know… the title sounds like a bad 70′s sit-com. But here’s the bottom-line: The Man really doesn’t appreciate you/us being in a “cash business” and will flex everyone of his muscles in an attempt to put the hurt on your wallet these days. That’s true of both business owners as well as bartenders/servers. Over the last 20 or so years – coinciding with the rise of the machine (read: computerization of anything and everything) – The Feds and your municipal tax thieves have been putting the smack down on our business like never before mostly because they have the ability to do so like never before. If they’re not all up in your grill today, rest assured that they will be paying your trusty liquor-dispensery a visit sooner or later in order to forcibly extract their not-so-fair share of your income.

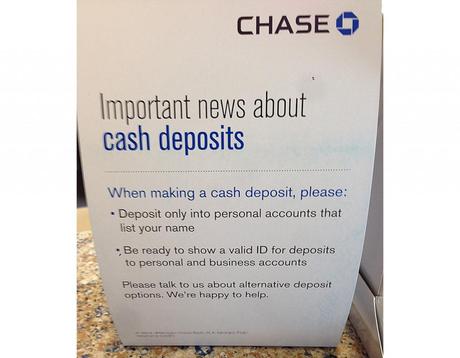

A while back, a went to make my usual weekly or bi-weekly deposit at my bank and was – for the first time – questioned as to whether or not this was my own account similar to what Chase started doing recently (pic above). Subsequently, I was asked for identification each and every time I made a deposit. I found this to be really weird but whatevs… I surmised that this was probably an attempt to weed out (no pun intended) dope dealers and their laundering efforts, not an attack on tipped earners.

- Red alert pops up on someone’s screen when an incorporated entity’s Corporate Tax is way out of whack with (a) Revenue (b) Net Operating Income (c) number of employees (d) liabilities (e) expenses and (f) payroll.

- Alarm bells ring off like a mofo when the SBA, Dept of Health, State Liquor Authority, etc. visit an establishment only to spot primarily NCR or other mechanical registers in active use in place of commercial Point of Sale systems.

- Routine and substantial cash deposits tip off The Tax Man too. The old legend of stuffing money under the mattress doesn’t exist for no reason. Typically, if you’re depositing hundreds/thousands of dollars in cash per week into one bank account, and do not have the corresponding income on your 1099 or 1040 to substantiate the deposits, someone’s going to eventually come looking to pin your ass to the nearest wall – James Brown, Willie Nelson and Lauren Hill style. That’s true of both employers and employees.

Now as a bartender or server, don’t get all freaked out (yet). If you’re documented (on the books) as 99% of NYC bartenders are these days, you’re mostly covered. Your employer will withhold that shitty $4.75 hourly rate for and report some of what you make to the appropriate authorities. I say “mostly” because I know very few bartenders who report (typically an option during P.o.S. system clock-out procedures) what they actually earn in tips.

But here’s the rub: each business has different rules for accounting for what tipped employees earn. In general, I’ve found that most bars/restaurants/clubs use a percentage of a particular employees sales (again via P.o.S.) to report to the government. That percentage is typically 12% or 13%.

So that raises a whole lot of concerns. What right do they have to do that? How the hell do they know what I actually earn? If I get frequently stiffed, I’m paying taxes on what I haven’t earned! I tip out x% to barbacks, split tips, etc., and didn’t actually make all that loot! Three of us bartenders use one register but I’m the one who is signed in and getting taxed! Is there a way to circumvent management reporting my tips?

So many questions… relax. Just keep this analogy in mind: no matter how increasingly secure they make locks, there will always be a person clever enough to pick it successfully. It may be frustrating and involve a corresponding increase in dexterity, but there is always a workaround to most challenges in life.

Back when I started bartending, before the dawn of Point of Sale systems (and even briefly after their introduction), bartenders received a “standard” $40 Shift Pay pretty much across the industry. There was no such thing as a check, clock-in/clock-out, official payroll register, P.o.S magnetic card, or any record (other than maybe a hand-written schedule) that you were ever actually employed. In other words, you were completely “off the books.” That $40 bucks was taken directly from the “till” at the end of each shift. That was the house’s way of compensating you for your time. Sigh… how I long to roll like that again. There are still a handful of pubs that employ this practice. But, it’s mostly deprecated unfortunately.

Anyway, with the advent of said computer systems and their invasion of every nook and cranny of our interactions, few transactions are going un-monitored (and thus un-taxed) these days. Welcome to a Brave New World – one that will likely never go back to the simple life.

Since this blog is focused on bartenders, I’m going to address the third alarm bell and bartenders’ concerns in terms of being appropriately (or inappropriately) taxed. I had a fellow bartender last year – Brad- who I bonded with for a variety of reasons. Brad was Hispanic, young, muscular, handsome, and talked a good bartending game – an instant hit with the ladies. He’d been bartending in NYC only for 3 or 4 years. He’d recently completed a bartending stint at an extremely popular Mexican-themed restaurant/club downtown which I think most New Yorkers have frequented at one time or another.

We’d talk the usual industry shit like hitting some random Strange, problem and funny guest stories, bitch about problems with the bar, etc. Among those conversations was one about his personal cash handling. Brad literally kept tens of thousands of dollars (bar earnings) in a shoe-box under this bed. But it got worse – he had roommates and frequent visitors. When I questioned him on why, he said that he feared The Tax Man. Based on naivety, I guess that may have been a somewhat reasonable fear. My immediate advice was for him to immediately start making relatively “small” deposits in the bank lest his place burn down or he get indiscriminately robbed by whomever. I advised him that at the income levels he’d be making deposits, versus what would be reported on his W2, he had little to fear.

Keep in mind, that if you make a singular cash deposit for $10,000 or more, your bank is required to report the transaction to The Man. Consequently, The Man (be it he IRS, State Tax Authority, NSA, OSI, FBI, CIA, or whatever) also has wicked automated computer software setup to trigger alerts when certain financial transaction criteria are met. I don’t know specifically what their alerting threshold entails, but I can bet that large frequent cash transactions will eventually have them thinking you’re the next Osama, Sheik Abdel-Rahman, Pablo Escobar, or Tony Montana (I bet this post gets me on the No-Fly List for even mentioning their names – thanks Sergey and Larry). The point being: if you don’t have reported income and appropriate stated employment coming somewhat close to match your cash deposits, you can eventually expect an certified letter demanding an audit (at best). At worst, you can reasonably assume that some no-knock, 3:00am raid by your not-so-friendly, highly-militarized NYPD ESU (assisted by perhaps a dozen similarly enthusiastic Federal goons in black armored Bradleys), will eventually make it’s way to your doorstep.I take it you like the smells and sights of flashbangs, eh?

OK… I exaggerate, but you get the point. Don’t do everything in your power to make yourself look like a tax dodger. At the same time, keep things in perspective: Manuel Noriega your are not. You’re a small-time bartender. Depositing a few hundred or couple of thousand dollars a week in to a legitimate bank account is not going to get you arrested. You’re woking an honest job, earning an honest living, at a legitimate (hopefully) enterprise. You have reported income and the bulk of your take-home pay is usually in cash – big deal.

So back to bartender reporting options. If you disagree with what your employer does in terms of reporting your tipped income, you basically have three options: (1) talk to him/her and get him/er to revise the policy [fat chance] (2) leave (3) do what The Man recommends: that is, keep a ledger of every shift’s earnings and report it manually on your 1099/1040. If you maintain accurate records, there is little chance you can get screwed on an audit (if what you earn is actually less than what your employer reports). Herein lies the problem with that (rarely am I not fully forthcoming) – the 100% truth is that many bartenders, if not most, actually earn far more than what is reported/documented. I’m not saying that I do or don’t fall into that description however. I’ve gone through the painstaking manual log-keeping exercise for myself and others in the past. I’ll leave it at that.