%%bloglink%%

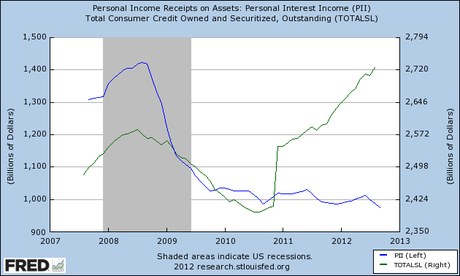

This chart is from the St. Louis Federal Reserve and shows Personal Income Receipts (the interest you earn from corporate bonds, government bonds, CDs and savings accounts) as compared to Total Consumer Credit.

The logic behind the Federal Reserve lowering interest rates is two parts 1) it becomes cheaper to borrow money so people who previously couldn’t purchase items that typically require financing such as cars, machinery or homes now could buy them because their payments will be lower. 2) Low interest rates also discourage banks and individuals to keep their money in savings/checking accounts because they don’t earn enough interest as compared to other investments such as stocks, bonds, loans, etc.

The problem I’ve noticed is the large and seemingly growing difference between the amount of interest savers are earning and the amount of interest borrowers are paying. According to Bankrate.com’s October 18th survey of interest rates, the average interest rate for a credit card is 14.56% and the average interest rate for a 1 Year CD is 0.30%.

Translated into dollars this means as August 2012 savers are earning $435.6 billion less annually than they were in August 2008! That is a billion with a B and annually with an A!

And who are these savers? I’ve heard them being called wealthy, frugal, the 1%, financial responsible, etc. Whatever their names, they seem to me to be the ones bearing the brunt of low interest rates.

What are you doing to offset any decline in interest you used to receive?