{via}

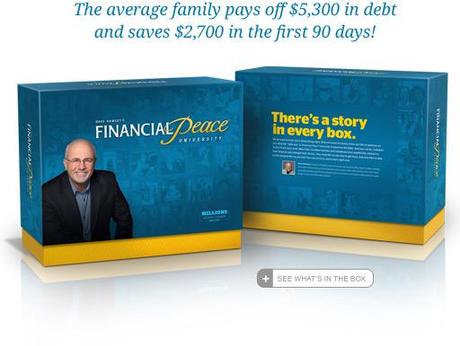

My parents had always stressed that my sister and I were supposed to take Financial Peace University (FPU) along with pre-marital counseling before we got married. Because Ryan and I had a short timeline, we agreed to take FPU as soon as we got to Arizona. I cannot tell you how much of a blessing this course was for us. Ryan always says, "FPU changed our life forever."

My parents had always stressed that my sister and I were supposed to take Financial Peace University (FPU) along with pre-marital counseling before we got married. Because Ryan and I had a short timeline, we agreed to take FPU as soon as we got to Arizona. I cannot tell you how much of a blessing this course was for us. Ryan always says, "FPU changed our life forever."

Check out more from Tamara: