Money has always been a touchy topic with me. Oh, I understand how it works, but I tend to be a little lazy when it comes to book keeping. And with March around the corner, I am practically living in dread over getting all the info together to file my tax returns. It is an activity I particularly do not love and treat it like a chore. I keep wishing I had a magic wand to wave and get it done. How nice it would be to have a personal money manager to do it all!

Shouldn't there be an app for it these days?Turns out there is - one that is very easy to handle!

I was delighted to find Money View on the Google Play Store. This is a free to download - and secure - app that is India-specific with lots of features.

I found it last week and am enjoying exploring it. I am pretty sure I haven't uncovered all its features, and look forward to discovering them. Applications are like that.

How does Money View work?This is probably the best part. After I downloaded the Money View app and signed up for an account, I was wondering whether I would have to fill in financial information on my phone screen manually to use the app, a task that I do not relish doing, as I find the small screen challenging.

So imagine my joy when I discovered that I wouldn't have to do that! As soon as I signed in, the app simply got to work. This reminded me of one of my Grandmother's friends back in the day. She would walk in, say hello, spend five minutes talking and then, tucking in her sari pallu, without further ado, just get busy!

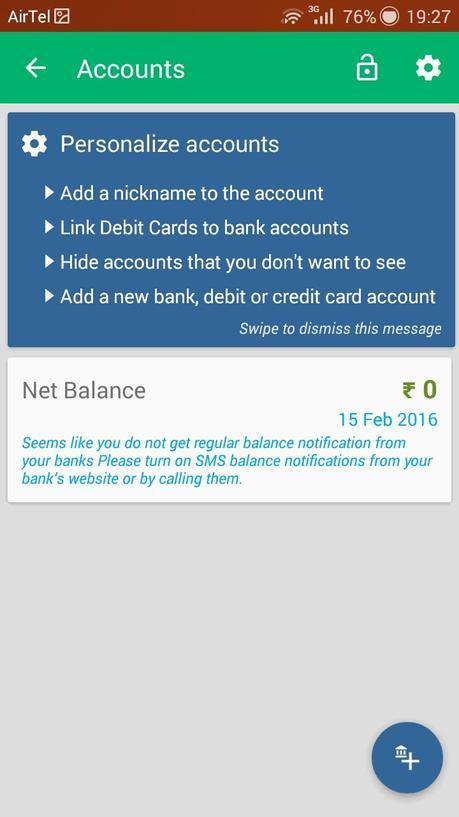

It was the same with Money View. It took the initiative and used my SMS - text messages, since I am subscribed to sms alerts for all things financial, to pull my spend trends and categorize them. It tabulated the info, allowing me to track and study my financial trends.

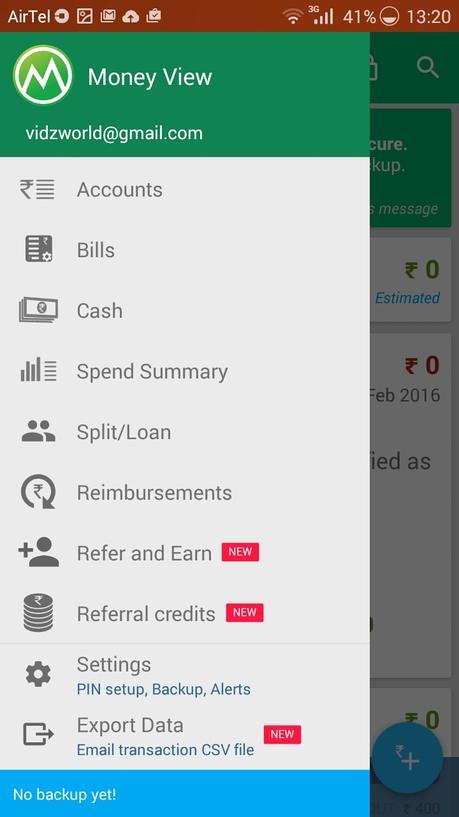

Here is a screenshot of the menu:

As you can see, it more or less covers everything you need to get your financial act together.

What about security?That's a critical aspect of any app, that too one that deals with finance. Money View is secure in a way that it doesn't read your personal messages, OTP or your bank login details. It comes with industry leading security and privacy protection.

There is a reason why Money View has over 3 million subscribers who trust it.

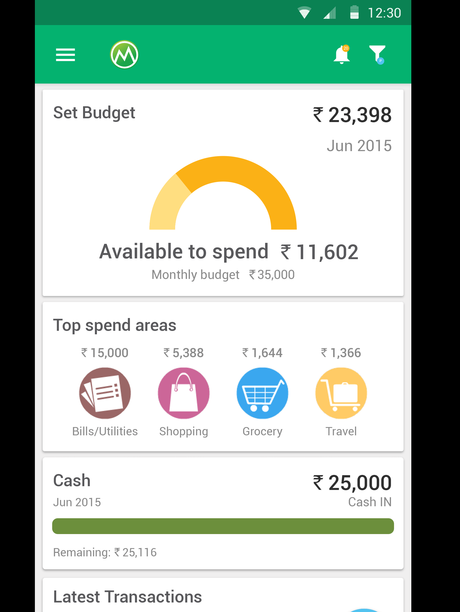

Smart finance management with Money View My favorite features are:- Ability to fix a monthly budget and track spends. With credit cards to help with cashless purchases, it is all too easy to overspend. Money View helps to track your spend and stay on budget, and also shows you your credit limit. It neatly - and - note this - automatically categorizes spends, making it possible to manage your budget and cash in real time. Keep track of how much is available to spend.

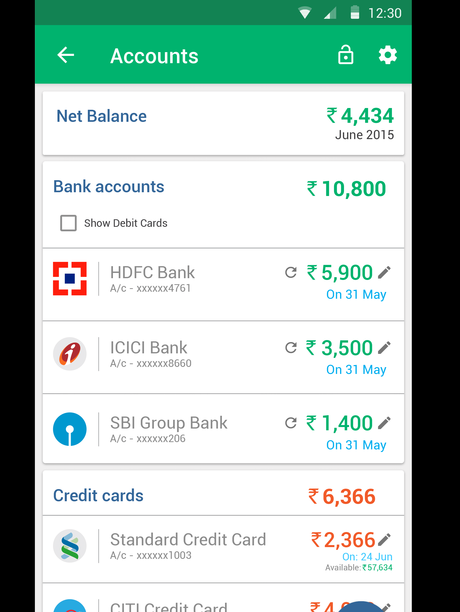

- A full financial snapshot of what's going on - including your bank account, credit card statement and loan accounts. You can see your actual account balances and analyze and make your decisions.

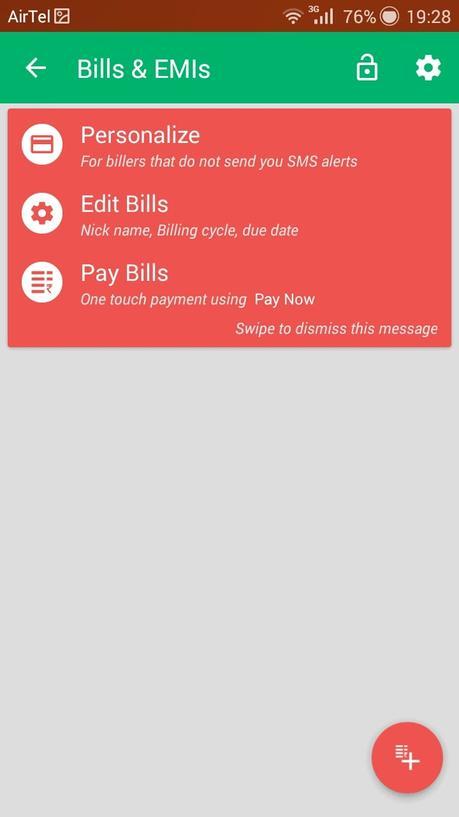

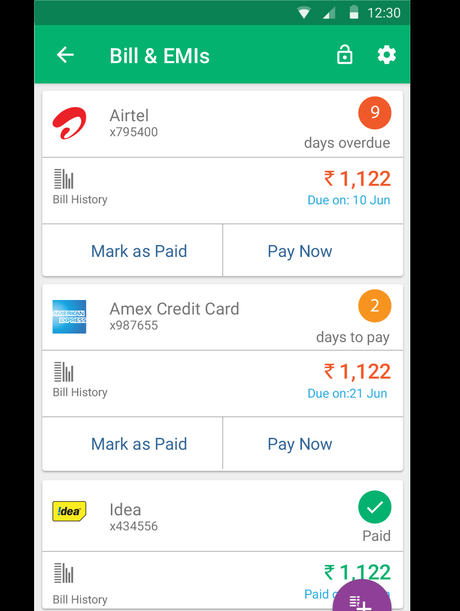

- Personalized alerts and reminders. This is a smart feature. If you have recurring bill payments - I do my bill payments online - electricity, phone, broadband, insurance and other things online and often find that it is the last date and I can no longer do it via the website - which means trudging up to the counter in my area, standing in queue, paying a fine and oh, imagine the rest. Money View updates, reminds and nudges you to do it on time preventing you from paying fines. It is a single point for all bills and allows single click bill payment.

- Reimbursement tracking. This one is interesting. I usually do my cab booking via the taxi app and must invariably keep track of those that are reimbursable. Money View helps track these easily and makes it very convenient.

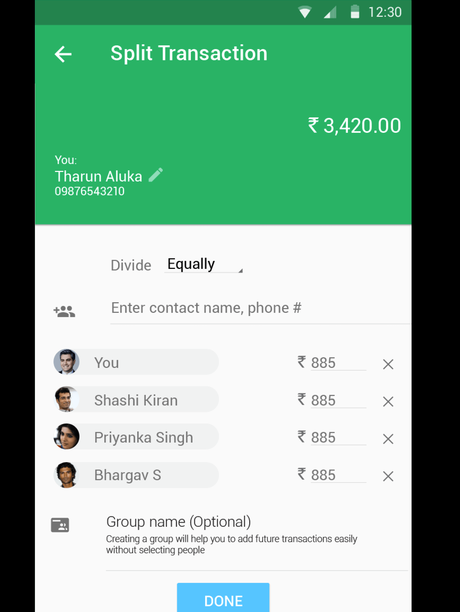

- Split bills - this one was a new one for me. Interesting - especially if you're going out and going Dutch over sharing the bills. You can split your bill with your family and friends. Especially useful for those who want to split the costs between roommates, while going on group travel and those get togethers. Neat eh?

I'd say my favorite thing about the app is its simplicity - there is nothing to set up and no manual entries to slog over. It just goes to work with the info available to present a real time view of your finances.

Okay - remember that if you do not have info in your phone's text messages, this won't happen automatically. But you can certainly allow it to handhold you through whatever you want to do.

Some things I learned:

- You can also export your data as a .csv file.

- Almost all major banks are covered

- You can add a pass code to the app for extra security

- There is a single click bill pay facility for certain billers via the Whiz Pay

- If you have been generous and given out loans, you can track those too. Same with loans you've taken.

- Bonus? Refer and earn, which you will find in the menu. Invite a friend and earn cash - and watch your balance stack up in the Referral credits in your menu.

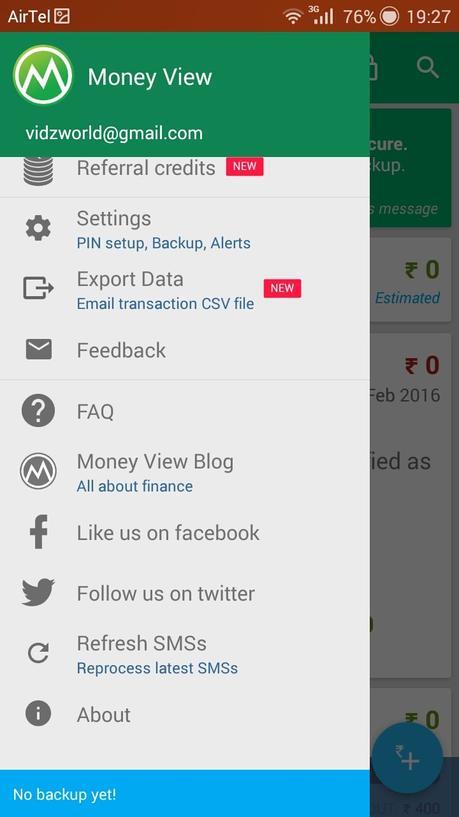

- There is an FAQ section where you can have all your questions answered.

The Money View Android app is a great way to simplify your personal finance management - download Money View here.

I hope they have an iOS version soon, it would be nice to sync the data across devices for easy reference, at least for viewing. One thing I know - this year's tax filing is going to be a lot easier!

Google Play Store link to download Money View https://goo.gl/0uNEmR

Visit the Money View website http://moneyview.inI found the Money View blog http://moneyview.in/blog informative - it is a great resource for all things finance for the Indian audience offering investment and money management ideas and knowledge-based articles.

Have you used the Money View app? Did you love it?To see their latest updates connect with Money View on Facebook and Twitter

Thank you for your comment ♥

Writer, editor, blogger, social media enthusiast. Love DIY, Coffee, Music, Reading, Photography, Family, Friends and Life. Mantra: Happiness is a DIY Project. In my free time I play with my dust bunnies and show my diabetes who's boss. Tweet as @vidyasury